The difference between research and Due Diligence

In our previous post, we introduced the concepts and importance behind client segments, discussing the commonalities and needs of those groups. In this post, we’ll look at how we can align the solutions.

The first thing to consider here is, there's quite a difference between doing research and due diligence and we need to carry out both, because once you've had your centralised investment proposition signed off, you don't need to provide individual case research. It's quite important to get this done once a year, and in a correct manner.

Research

-

Identifying the relevant criteria based on the needs of the target market, client segments.

-

The initial filter from the range of available products, or services

-

Typically the research is carried out using research tools e.g., Defaqto, FE Analytics, The Lang Cat, Adviserasset etc.

Due Diligence

Due diligence really comes after the research. This is where you've whittled down a shortlist of providers that you may be comfortable working with. What you're effectively doing then, is really lifting the bonnet and understanding what is critical to you and your clients.

-

A more detailed analysis of the products/providers identified as potentially suitable through your research process to ensure they are fit for purpose.

-

Liaising directly with the provider for information that may not be readily available through primary literature and marketing material.

-

Identifying and understanding the primary risks associated with any provider that you may include within your proposition.

Six stages of research

- Select criteria parameters (be specific). You're looking at the whole of the market, and you're deciding, what are the critical parameters that you would like to bring in as a filter through whichever research tool you're going to use.

- Explain in your documentation why the criteria has been selected. Out of your criteria of maybe 4 or 5, Why has that been selected? What is the relevance of that to the client segments you're looking at?

- The research process used to identify the solutions which meet your criteria. This is really talking about how you want to research them. So, you've got your filter criteria and now you need to decide which tool(s) to utilise i.e. Defaqto etc.

- Shortlist of solutions meeting your criteria.

- Explanations where you reject particular shortlisted solutions. I've rejected X and Y because of [reason].

- Final selection with explanations and how they meet your clients’ needs. How they meet the needs of the client segments you’ve identified.

Good Practice Research

Research needs to be objective and consider the full range of providers offering relevant products.

You can't create a shortlist from outset. You need to think of the whole of the market and what the filters are you're going to use to bring that down to a short list of providers.

Avoid retrofitting.

Try and avoid thinking of what you want the solution to be and subsequently carrying out the research to back up the solution you already had in mind.

Decide on your criteria and the importance of those criteria, for example what is essential vs preferable.

It maybe you have a preferable criterion that you want, and several tools enable you to do that as well.

Ensure that the criteria includes relevant requirements of the particular client segments, the products are to be used for.

For example, retired clients may need a platform offering greater functionality and options around drawdown. Younger clients accumulating over the longer term may be better served by simple, lower cost platforms or no platform at all, it could just be a standalone pension product in this example.

Set specific criteria parameters, i.e., 1st quartile risk adjusted returns over 1,3 and 5 years.

When you're drafting your criteria, make it specific. For example, don't just say ‘good’ or ‘above average performance’ because over what timeframe? etc.

How do you quantify it? It needs to be quantifiable. In this example, set specific parameters, risk adjusted returns over 1, 3, and 5 years.

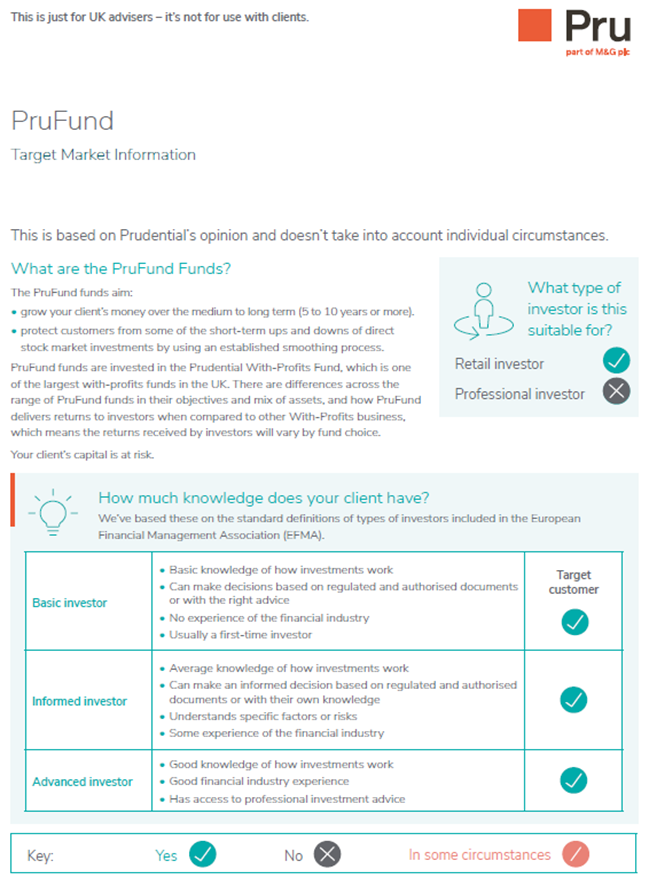

Provider target market descriptions

This is talking about being specific about your client target markets, but also marrying it to the providers. Some of the providers may have quite generic target market descriptions, so you must bear that in mind, as well as your knowledge and understanding of the industry to ensure that that product is suitable for your target client market.

This example shows their target market information for their fund range.

Things to consider are:

Which target market are you looking to use the product for?

Consider that when you start your journey, which of your segments are you looking to use the product for?

Review what they believe their target market is.

Certain solutions may not be deemed suitable for the retirement space and so don't just assume the products are fit for your target client segments, find out what they are.

Are these compatible with your client target markets?

Document your reasons for use and how this helps deliver on the four consumer outcomes. You need to think about how this product is suitable and also helps you to deliver on the four consumer outcomes.

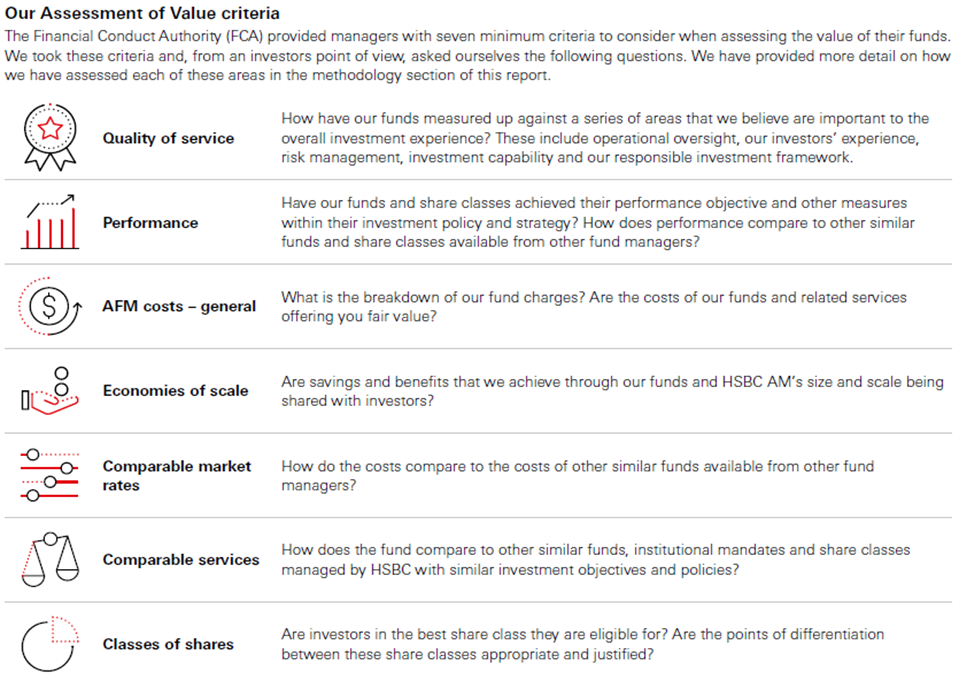

Value Assessments

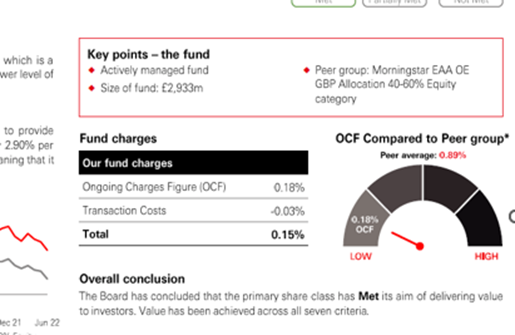

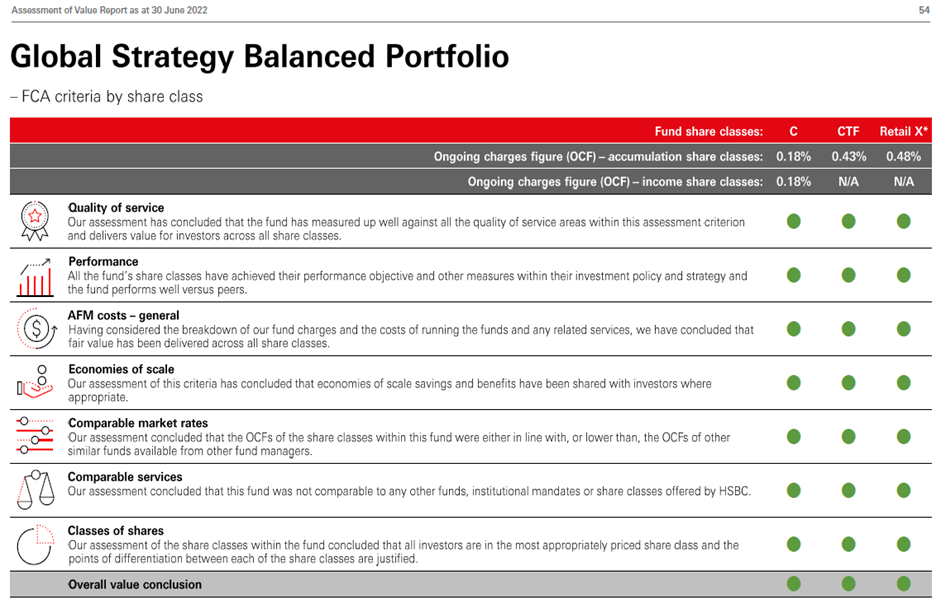

The other thing to bear in mind is that the FCA set a minimum criterion of seven, as shown above, that they expect asset managers to consider in respect of carrying out a value assessment of their funds.

What we have here from a HSBC perspective, you’ve got a bit of a description of the solution, the charges, etc, and where they see the OCF compared to its peer group.

You’ll also then see the minimum seven criteria, and how they judge it to be green in every box, in respect of it being met. They've also listed for the various share classes that they run. This is important documentation to get hold of because this is your starter to effectively say: Does the provider even believe that their product or service, or investment solution is value for money? They are available, so get them from the providers that you work with.

Due Diligence – Good Practice

- Most providers will have standard due diligence documents you can access on request.

- Think about the information that you want to understand about the providers being considered and ask specific questions. So don't be shy about, directing specific questions to them, as well as what’s in their standard pack.

- Make sure you understand the risks and limitations of the products, because that’s essential from a client’s perspective.

Things that may be important for your firm/clients:

Ownership

We’ve had a lot of providers etc changing ownership recently or being acquired.

Profitability

Are they likely to be in that market for a period of time, possibly with a parent? A parent company may only wish to provide financial support for so long.

Scale

What is their core business?

Is their focus purely on the area that you wish to work with them on or do they have other areas that could be diverting their attention?

Commitment to market

Technology

Are they likely to re-platform? What is the position in respect of the technology and is it proprietary or outsourced?

SLA’s

The SLAs are crucial to you in delivering on the Consumer Duty, in respect of your clients.

Execution policy

Important when using investment managers.

Fund/investment availability and process to add new funds.

Training and support

Access to senior management

This is not an exhaustive list, but just some things to consider when you're looking at due diligence. Again, you can tick them off in the pack they provide for you, but there's no harm in sending specific questions to your shortlisted provider to ascertain what their position is in this respect.

Listen to the entire episode now

To listen to the entire podcast episode now, click on the link below.

Find out more

To find out more, we have an Advice Proposition Masterclass hub, which is freely available to subscribers of Sense and Lyncombe Networks. Here you can find a suite of webinars with helpful support on the various aspects of advice proposition development, including a dedicated episode on ensuring that you are prepared for Consumer Duty.

If you are interested in finding out more about the suite of support services available to you as members of the ASHL Group networks Sense and Lyncombe, get in touch today.